About the best thing about some of the recent consultations has been the focus on various fees on road users in different ways. Some are no-brainers, others less so. There's some shyness about taxing motorists, in large part because of the unpopularity of the brief period of the Toronto Vehicle Registration Tax, which both managed to raise the ire of many, as well as not not particularly generating a lot of income for the city. Not to mention it likely contributed to getting what's-his-name elected mayor. The thinking being, I guess, that since the right seems to have won some battles on this issue, those interested in thoughtful and good policy should just roll over and surrender the war.

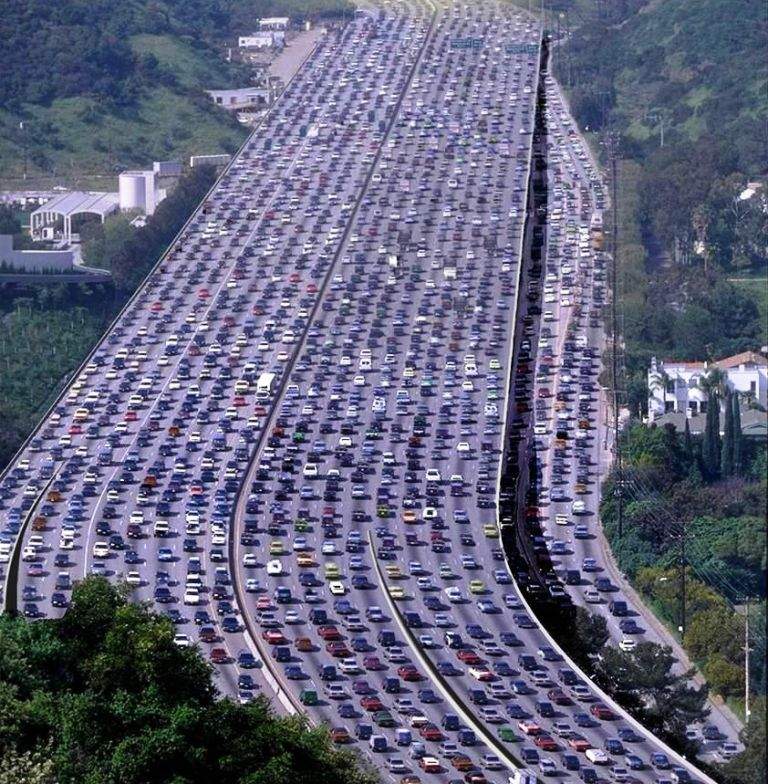

About the best thing about some of the recent consultations has been the focus on various fees on road users in different ways. Some are no-brainers, others less so. There's some shyness about taxing motorists, in large part because of the unpopularity of the brief period of the Toronto Vehicle Registration Tax, which both managed to raise the ire of many, as well as not not particularly generating a lot of income for the city. Not to mention it likely contributed to getting what's-his-name elected mayor. The thinking being, I guess, that since the right seems to have won some battles on this issue, those interested in thoughtful and good policy should just roll over and surrender the war.I have some sympathy for drivers - maybe because I am one occasionally, plus I grew up in the suburbs where a car was fairly necessary. Drivers figure they already pay gas taxes and other taxes to pay for roads, plus a whole bunch to run their vehicles, and don't want to pay more. But this points to the inefficiency of motor vehicles for transportation as much as anything else. Cars are deeply tied into our North American mythology of independence and the free market, but are in fact the result of major government spending over many decades, and all that spending came out of years of taxation as well.

Figuring out the details of car subsidies is tricky. Many of the external costs of cars outside of just road building are hard to calculate - the health and environmental costs, for instance. Parking is one of the easier elements to figure - free or cheap street parking costs government at least $60 a month, and likely much more. In Ohio, they did a study that found that the government subsidizes 40% of the cost of driving. Perhaps more telling is that they also found it costs $1 per mile to drive a car, vs 67 cents for commuter rail.

Transit subsidies are mostly easier to figure. Transit users in Toronto pay for themselves almost entirely, with fares covering about 70-80% of the cost of the TTC, with the other 87 cents per trip being a subsidy, making it essentially the least subsidized transit system in North America.

If we're talking about the entire GTHA, Go transit riders pay an even higher percentage of the cost of their trip through their fare. But then, if you're taking the bus in the suburbs, you're likely much more heavily subsidized.

If we're talking about the entire GTHA, Go transit riders pay an even higher percentage of the cost of their trip through their fare. But then, if you're taking the bus in the suburbs, you're likely much more heavily subsidized. I point some of these things out in an effort to add to the chorus of seeing transit funding not as an attempt to just tax resentful drivers, but tie it to an attempt to make all citizens equally valued no matter what transit mode they choose. I fear the current discussion throws a bunch of car-taxing transit tools at a wall and hoping some of them stick, rather than really re-examining our collective goals as a society, such as equality.

Ultimately, for a variety of reasons, we may decide to subsidize transit more than drivers, for a whole range of reasons. But keeping the status quo out of fear in a broken system is not an option.

So, what could we do?

1. Parking Levy: This is the most no-brainer of all the options on the table. Not only are no drivers or individuals charged directly, but it also has the potential of encouraging developers to build less parking, and nudge them towards less big-box retail and more dense and pedestrian friendly design. It also has the potential to raise $1.2 - 1.6 billion a year throughout the GTHA. Unlike some of the other tools, it makes sense that those in urban areas would pay this, rather than those elsewhere in the province.

2. Gas Taxes: It seems pretty easy to add a few cents to the cost of gasoline. It would make sense, too, given that the price of gas has risen substantially over the past number of years, (nearly double the last decade) and by charging per litre rather than a percentage, the government has been increasingly taking less of a percentage of each litre sold. A percentage might then make more sense than a cents per litre charge. Another option, currently scuttled, would be a carbon tax to pay for transit, such as exists in BC, and would apply on gasoline as well. Unlike the others, which I think the city of Toronto could do on their own, this makes the most sense for Metrolinx and the province to do.

3. Vehicle Registration Fee: You know what they say - if at once you don’t succeed... Despite the aborted attempt at a Vehicle Registration Tax in Toronto, we already have a provincial registration fee which I don’t hear any provincial political party promising to repeal. However, maybe a random number isn’t the way to go... Adam Vaughan briefly proposed, once upon a time, to link the cost of a metropass to the Vehicle Registration Tax, which is a great example of potentially linking transit funding and driving in an equitable way. It also points to a way to make it politically more salable; unlike other costs that are hard to pinpoint, you can directly link it to another decision. As an example, the NDP recently had success with pushing a 15% cut to auto insurance. For me that would mean about a $15-20 a month savings, or about $100 a year. This could be a huge opportunity to make a tax not like a tax, by instituting an increased registration fee of $120 a year at the same time, I’d still be in the black.

Having said all that, the Vehicle Registration Fee is a bit of a blunt instrument, which unlike other fees, is the same whether you have a gas-guzzling suburban or a smart car. It also has a lot less potential to bring in the kind of revenue needed to pay for very much.

4. Road Tolls: I sort of have a soft spot for our free highways - I remember visiting the US as a kid, and I always thought that our lack of toll roads said something about how our government ran effectively and provided services for people for (seemingly) free. However, if no one's going to listen to me about raising income or corporate taxes, then sure, go ahead and toll. I do think this is the hardest sell to drivers, especially in areas under served by transit, if there aren't new roads being built. The places in which it would work best are areas well served already by transit - in particular the DVP and the Gardener. I'd prefer they tore down the Gardener, but if not, by all means toll it at double what it would cost to rebuild and maintain properly, and put the extra half towards transit. I sure don't want another penny of my (usual) tax dollars to go to that thing.

I'm not saying anything new when I point out that for decades we've built our cities and towns to favour cars. Fossil fuels are diminishing our health, the health of our environment, and have drastic consequences for the planet. I'm sick of asking people to do nice things on this front - so maybe it's about time for some sticks. For 2 years, I lived in Alberta, where the oil industry infects the government, and scars the landscape. In the last 2 weeks, I watched a documentary about how the Caribou are going extinct in Alberta because of oil, and also went to what I thought would be a serious discussion about oil, industry and the environment, but featured a walking talking industry advertisement named David Manning who gets paid by Alberta government tax dollars working in the Ministry of Truth (TM).

I'll cut that rant short, but just say that we need to get serious about some of these larger issues, and although there's a limit to what we can do about environmental issues through transit funding, I think it's time we got serious in a big and holistic way. We shouldn't give up on proven revenue like income and corporate tax. But if taxes and revenue is being shifted to fix some of the disparity of the car and oil friendly policies of the past 50+ years, and towards complete streets and amazing, safe, healthy, livable communities and awesome transportation for everyone, then I'm very fully on board.